However, you will need to submit the completed form and all backup documentation to each tax agency involved and each agency will review your offer independently. This success translates into hundreds of thousands of dollars in savings to our clients.

Office Of Sustainability

$5,000 is the key threshold for the ustc when dealing with back taxes.

Franchise tax board fresh start program. Collection activity may continue while settlement is reviewed (garnishments, liens, seizures). All payments must be certified funds. “filing a return, paying a tax bill, getting a new form, and checking refund status just became more efficient.”

The california franchise tax board (ftb) launched a similar “fresh start” program in march 2012. Here we go through the basics of the irs fresh start program and where things are at in […] 28 mar, 2021 in irs debt / irs payments / offer in compromise / tax guide / tax liens tagged fresh start / irs / liens / news / offer in compromise / payment plans by robert kayvon, esq. Yes, you can deal with the irs or franchise tax board yourself.

Here’s what you need to know about making payment arrangements to pay back taxes with the idaho state tax commission. File a return, make a payment, or check your refund. Monthly payments are based on their current income and the value of their liquid assets.

(company number 201129910171), 2070 granite hills dr, el cajon, 92019 Hopefully the information below will get you started resolving yourmichigan tax debt. The ftb has an innocent spouse program that provides tax relief for those taxpayers who otherwise are not responsible for their spouse/rdp’s (registered domestic partnership) delinquent taxes owed.

If you owe less than $5,000 the ustc, utah should give yo up to 24 months to pay off your tax liability in monthly installments. If accepted, the settlement amount usually must be paid within 10 days of acceptance. The undersigned certify that, as of july 1, 2021 the internet website of the franchise tax board is designed, developed and maintained to be in compliance with california government code sections 7405 and 11135, and the web content accessibility guidelines 2.1, or a subsequent version, as of the date of certification, published by the web accessibility initiative of the world wide web consortium at a.

Franchise tax board (4) historical (12) international tax news (16) irs news. Payment plans can not extend longer than 18 months; The ftb refers to this process as establishing a “provisional payment plan.”

The irs has increased the minimum liability for filing a tax lien from $5,000 to $10,000. California franchise tax board innocent spouse relief. Other options that could be viable, depending on the circumstances, inclue offers in compromise (part of the “fresh start” program), challenging the liabilities at the audit or administrative appeals levels, challenging the liabilities in court, innocent spouse relief, or utilizing collection due process procedures.

You could start with the super boring taxpayer rights handbook, but it’s pretty boring. Irs tax liens and the fresh start program increase in the notice of federal tax lien filing threshold. If you owe $25,000 or less to the ftb, you can “do it yourself,” either by calling a.

If you still need help, reach out to us using the contact form to the right of this page. The policy behind the offer program is to afford taxpayers a “fresh start”, while collecting what is potentially collectible at the earliest time, and at the least cost to the government. This is a program that allows tax payers to pay off substantial tax debts affordably over a period of time of 6 years.

“the new site is leaner and cleaner, and easy to use,” said state controller and ftb chair betty t. Sorry, no formal offer in compromise program. One of the biggest improvements in the irs fresh start program is the increase in the irs notice of federal tax lien filing threshold.

Over the years delgado & associates has successfully represented taxpayers before the internal revenue service, franchise tax board, employment development department, and the california department of tax and fees administration. If you owe $25,000 or less to the ftb, you can “do it yourself,” either by calling a. What is the irs “fresh start” program?

Follow the links to popular topics, online services. The minimum monthly payment is $25. 5% of offered amount must be sent with application for settlement.

You can avoid a tax lien by paying the tax debt within 6 months; As such, an offer in compromise may be a more attractive alternative than a protracted installment agreement. Log in to your myftb account.

In an effort to provide further guidance regarding the irs fresh start program, the irs is offering a free webinar on september 12th. You can submit an offer in compromise to settle franchise tax board, employment development department and state board of equalization taxes all using the same form. The program is intended to provide greater.

“this is part of a wider effort to help taxpayers and businesses to help give them a fresh start with their tax obligations.” the new vcsp is designed to achieve tax compliance while also reducing the financial impact on employers. State of idaho offer in compromise. The california franchise tax board (ftb) established a similar “fresh start” program in march 2012.

Michigan department of treasury back tax relief get started resolving your state tax liabilities using the information below. Ut tax commission monthly payment plan. Free and open company data on california (us) company san diego fresh start program, llc.

Officials also issued more than 30,000 direct deposits but the majority were sent to households before october 15. The california franchise tax board (ftb) launched a similar “fresh start” program in march 2012. The cftb estimates that all state stimulus checks will be sent out before the end of the year, as reports

The most recent set of payments were mailed on november 15, according to the california franchise tax board.

Its Been A Few Years Since I Filed A Tax Return Should I Start Filing Again Hr Block

Tax Funny Cooking The Books Taxes Humor Tax Time Male Sketch

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Strategies For Parents Of Kids With Special Needs - The Autism Community In Action Taca

How Much Do Top Footballers Make Salaries Earnings Income Sponsorship Others Radamel Falcao Lionel Messi Falcao

How To Open A Hair Salon Business Hair Salon Business Hair Salon Marketing Small Hair Salon

Tax Return Solutions

Free Tax Preparation Mexican American Opportunity Foundation Maof

How To Set Up A Non Profit With 501c3 Status Non Profit Start A Non Profit How To Plan

Audit Report Powerpoint Template Excel Dashboard Templates Infographic Powerpoint Audit

How To Apply For Krispy Kreme Franchise Costprofit Krispy Kreme Franchising Franchise Cost

Pin By Infinity Real Estate Investmen On House Hunting Home Buying Tips Home Buying Buying A New Home

Irs Form 540 California Resident Income Tax Return

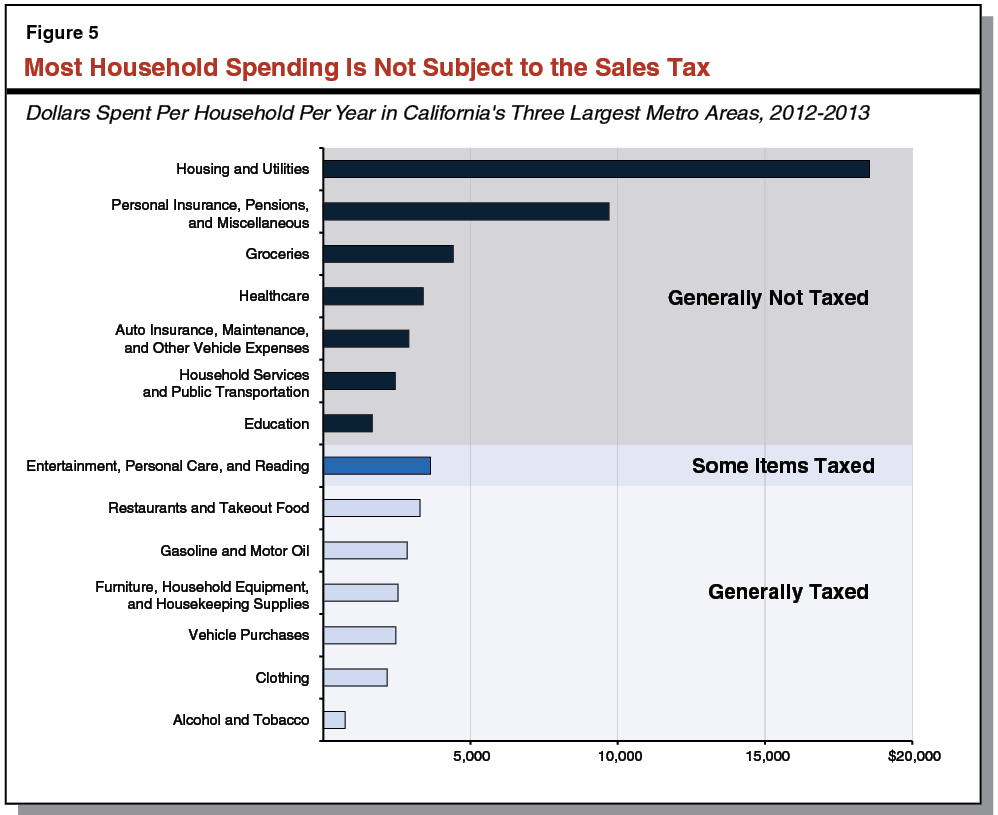

Understanding Californias Sales Tax

Pin By Topropkopop On 1 Life Coach Training Certified Life Coach Life Coaching Courses

Irs Form 540 California Resident Income Tax Return

We Love This Email Huntington Beach Public Library Made With Libraryaware And Absolutely Adore The Programs Learn To Run Couch To 5k Library Programs

Understanding Californias Sales Tax