Having a bad credit score may mean some lenders will be reluctant to give you a loan or other credit product, or, depending on the loan type and lender, they may charge you a higher interest rate compared to someone with a good credit score. And that’s all a credit score is — an estimate of the likelihood you’ll pay back the next credit you’re granted, based on the data in your credit reports.

Know What Credit Score Level Is Required To Get Any Loan Credit Score Free Credit Score Good Credit

Scores typically range from 300 and 850, and the higher, the better.

What is someone is starting credit score. Credit scores are a number between 300 and 900 that serve as a reflection of your credit report and trustworthiness. But it's highly unlikely your first credit score will be that low, unless you start off with very poor credit habits. However, someone who has already missed many payments might experience a smaller point drop from a new.

Building your credit with a loan from stilt You may need to open a new account or add new activity to your credit report to start building credit. At that point, your credit score is determined by the way you use that.

Nor will your first credit score be the highest level (under the two most commonly used credit scoring models, fico ® and vantagescore ®, that's 850). So, for many people the answer to the question, “when does your credit score start?” is at a young age, upon obtaining a credit card or two. Fico credit scores typically range from a low of 300 to a high of 850.

What is a credit score? There are other credit score models, but they’re rarely used. You’ve managed your bank account responsibly, paid all your bills on time every month and used a credit builder card to build up your credit score.

The card doesn’t have a monthly fee, but it has a small annual fee. What qualifies as a good credit score? Unless you make some big.

The higher your credit score is, the better your chances of approval will be and vice versa. This shows potential lenders how often your payment have been on time — or if they have been late or missed. Now, it’s time to start reaping some of the benefits of your hard work.

It’s possible to get an 850 credit score, but it’s tough to achieve. Your payment history is the single biggest factor that contributes to your credit score. The higher your score, the more creditworthy you are.

The higher the score, the better a borrower looks to potential lenders. Your credit score is determined by factors like the number and types of bank accounts you have, your credit history, used versus. You can use the factors determining your credit score and the weight that each of them carries towards making up your score.

This is generally because you would be seen as a higher risk and less likely to be able to repay the credit. The fico score is the brand of credit score used by most consumer lenders, so it's the one to pay the most attention to. You begin to build your credit score after you open your first line of credit, such as a credit card or a student loan.

You’re more likely to repay your debt obligations on time, so more creditors and lenders will be willing to approve your applications and. Your credit score can range from 300 to 850. The credit score is the looming shadow that watches over all of us.

The average credit score is 710 and most americans have scores between 600 and 750, with 700+ considered to be good. You can check if your credit score has started, and what it is, from any one of the three major credit reporting agencies (equifax®, experian®, and transunion®), or sign up for an online service to check, track and improve your credit score. Free credit score sites usually rely on vantagescore.

The closer you are to 900, the better your score is considered and the more. The factors that contribute to your credit score are as follows: Opensky doesn’t check your credit when you apply, but you must provide a deposit of at least $200 to get started.

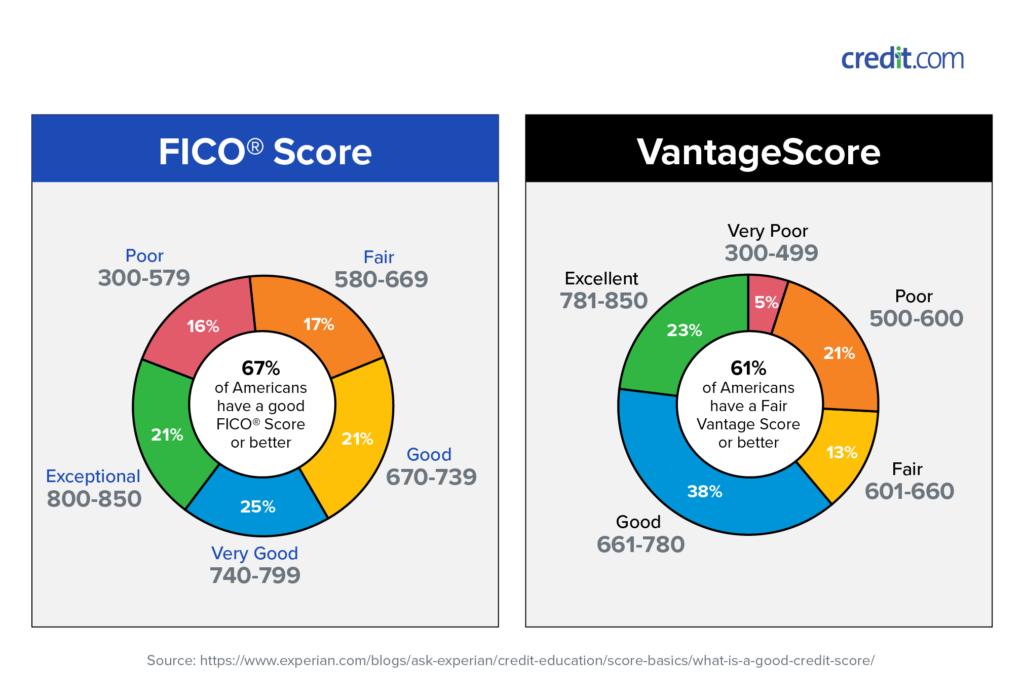

And, just like schools do with your gpa, lenders examine your credit score (among other factors) when you apply for their products. Fico considers a score between 800 and 850 to be “exceptional,” while vantagescore considers a score above 780 to be “excellent.”. You can find the exact weightings and factors used in the fico model here.

A credit score helps lenders evaluate your credit profile and influences the credit that’s available to you, including loan and credit card approvals, interest rates, credit limits and more. Once you begin using credit. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45% of your number.

Depending on your credit, a single hard inquiry can ding your score by five points, and multiple inquiries in a short amount of time can have a larger effect. You can compare your estimated credit score to the credit ranges to check the quality of your credit. The best credit score and the highest credit score possible is 850 for both fico® and vantagescore models.

Hard inquiries are recorded on your credit report under the “recent credit inquiries” category, and they do affect your score. Your credit score is based on information supplied by lenders to the major credit bureaus and compiled in your credit reports. Even if you have a perfect payment history, for instance, you may start out with average or “fair” credit because you have limited credit history or a poor credit mix.

Lenders that don’t care about credit scores are going to… If you want any form of loan, you need a credit score to back it up. You can check your equifax fico score through myfico, which shows all 28 fico credit scores.

Once you begin to establish a credit history, you might assume that your credit score will start at 300 (the lowest possible fico ® score ☉). Fico is more widespread, with over 90% of banks, credit card servicers, and loan companies relying on fico credit scores. Apply for a better credit card.

According to the issuing bank, customers usually see an increase in their credit scores within six months, and activity is reported to all three credit bureaus.

What Is A Good Credit Score Credit Score Chart Good Credit Score Credit Score Range

Find Your Credit Score Find Your Credit Score-find Your Credit Score Find Your Credit Score-anyone Whos Ever Credit Score Credit Karma Good Credit

Do You Have Bad Credit Or Know Someone Who Do Well Mark Your Calendar Come Out On Sat Aug 31 From 10-noon To Learn Credit Score Financial Seminar Bad Credit

Pin On Calgary And Area Real Estate

Whats A Good Credit Score To Have How To Get It - Valuepenguin

What Is A Good Credit Score Creditcom

Personal Loans Online Credit Score Personal Loans Online Personal Loans

Understanding Credit Scores - When Reviewing Applications For Credit Lenders Review A Variety Of Information To Help Them Dec Credit Repair Credit Counseling

What Is The Starting Credit Score - Savingadvicecom Blog

Learn Several Methods For Building Your Credit History Whether You Are Just Starting Or Building It Back What Is Credit Score Credit Score Chart Credit Score

Credit Repair Flyer Template Luxury New Template Credit Repair What Is Credit Score Credit Score

Friends First Company Good Credit Credit Score Good Credit Score

This Credit Score Chart Shows The Different Credit Scores When Taking Out A Loan The Higher The Credit Sc Credit Score Chart Credit Score What Is Credit Score

Understanding Your Credit Score And Why It Matters Envision Financial

Learn What A Credit Score Is How To Find Out Your Credit Score How You Can Improve Your Credit Score Tips For Avoiding Debt What To Look For When Applying F

No Credit Score Doesnt Mean A Zero Credit Score - Nerdwallet

Viubtyy_jlx-nm

Beginners Guide To Credit Scores Credit Score Chart Improve Credit Score Credit Repair

Shapemycredit Cpn Number Ad Scn Number Provider Check Your Credit Score Credit Score Chart Credit Score